Explore web search results related to this domain and discover relevant information.

Norfund is an investment firm that invests on renewable energy, financial inclusion, scalable enterprises, and green infrastructure sectors. ... Get predictions on funding, acquisitions, IPOs and more.

Norfund aim to invest in countries where they can have the greatest impact. In countries where the private sector is weak and access to capital is scarce. This is primarily in Sub-Saharan Africa, but · also in some countries in South East Asia and Central America. ... Don't miss out! Over 3K investors and strategists have used predictions to forecast the next hot startup. ... Hindu Business Line — Sovereign wealth funds, pension funds to get 5 more years to invest for IT exemptionsOslo, Oslo, Norway. ... AI Content may contain mistakes and is not legal, financial or investment advice. Learn more. Terms of Service | Privacy Policy | Sitemap | © 2025 Crunchbase Inc. All Rights Reserved. ... Operating Status of Organization e.g. Active, Closed ... This describes the type of investor this organization is (e.g. Angel, Fund of Funds, Venture Capital)Norfund is an active, strategic minority investor.This describes the stage of investments made by this organization (e.g. Angel, Fund of Funds, Venture Capital)

The Norwegian Investment Fund for Developing Countries (Norfund), is the Norwegian development finance institution. It was established by the Norwegian Parliament in 1997 and it is owned entirely by the Norwegian Ministry of Foreign Affairs.

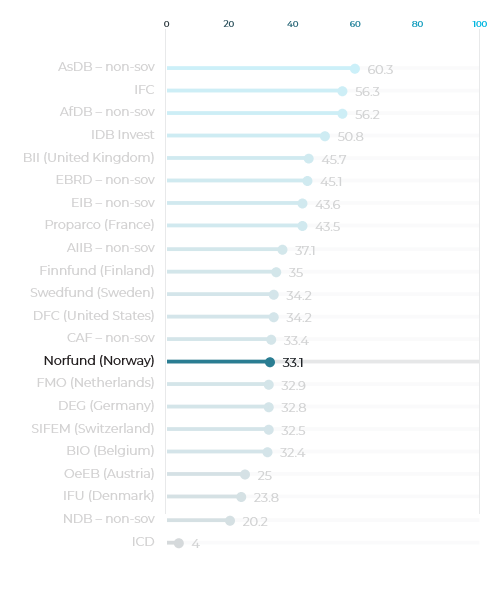

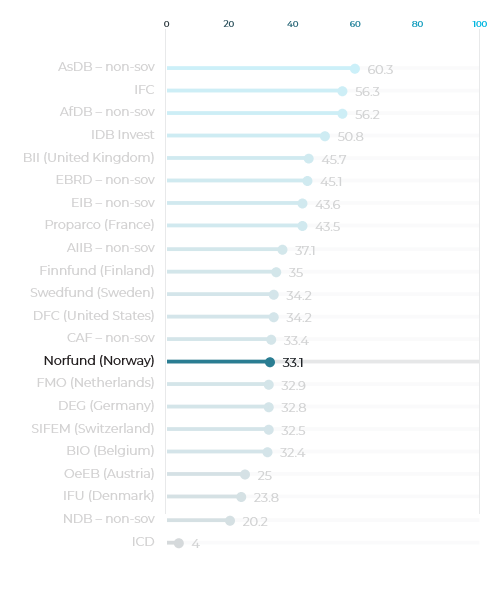

The Norwegian Investment Fund for Developing Countries (Norfund), is the Norwegian development finance institution. It was established by the Norwegian Parliament in 1997 and it is owned entirely by the Norwegian Ministry of Foreign Affairs. Norfund joined the European Development Finance Institutions Association (EDFI) in 2001.Norfund came sixteenth in the Core Information component, with 5.71 out of 20. It scored for thirteen out of the seventeen indicators, failing to score for disclosure/access to information policy, funding source, E&S risk category, and progress dates.Norfund came joint second-last in the Financial Intermediary (FI) Sub-investments component, with 1.25 out of 10. It was one of five non-sovereign DFIs to score for disclosing private equity fund sub-investments.Norfund should disclose further Core Information data including unique identifier, sub-national location, sub-sector, total investment cost, disbursement data, funding source, E&S risk category, date of activity disclosure, approval date, signature date, and last update date.

Norfund invested a record-high NOK 7.7 billion in 2024 and mobilized an additional NOK 7.8 billion in private capital (attributed according to OECD Methodology). The fund’s operating costs were 1 percent of the committed portfolio.

At the end of 2024, a total of 712,000 people were employed in the companies in which Norfund is invested. Figures from companies the fund has invested in and received reports from for two consecutive years show a net increase in new jobs of a record-high 41,400 (8 percent) from 2023 to 2024.Norfund is a state-owned company under the Ministry of Foreign Affairs, established in 1997 through the Norfund Act, to “establish viable, profitable businesses that would not otherwise be initiated due to high risk.” Norfund invests on commercial terms as a responsible minority investor in collaboration with partners. ... A development mandate aimed at creating jobs and improving lives by investing in businesses that drive sustainable development in four investment areas: renewable energy, financial inclusion, scalable enterprises, and green infrastructure. · A climate mandate, managed through the Climate Investment Fund since 2022, aimed at investing in the transition to net zero in emerging economies.In recent years, Norfund has annually received NOK 1.68 billion for the fund’s development mandate and NOK 1 billion for the Climate Investment Fund. In December 2024, Norfund received NOK 250 million for a new Ukraine mandate.The total return on Norfund’s investments was 8.4% in investment currency (19.6% in NOK) in 2024. The average return since inception has been 5.2% in investment currency (8.7% in NOK). · The Climate Investment Fund has had an average annual return of 14.4% in investment currency (19% in NOK) since its inception.

When asked about Norway's sovereign wealth fund winding down its investments in Israeli companies, Trond Grande, deputy CEO of Norges Bank Investment Management (NBIM), said the fund would continue to be invested in Israel.

The move came after a request from the Norwegian Finance Ministry that NBIM review its management mandate and its investments in Israeli firms. At the end of June, the fund was invested in 61 Israeli companies, 11 of which were not in the Finance Ministry's equity benchmark index.Overall, the fund's return was 5 basis points lower than the return on its benchmark index. "The result is driven by good returns in the stock market, particularly in the financial sector," Nicolai Tangen, CEO of Norges Bank Investment Management (NBIM) — which manages the fund on behalf of the Norwegian population — said in a statement on Tuesday.NBIM manages the fund on behalf of the Norwegian population.Norway's $2 trillion sovereign wealth fund — the largest of its kind in the world — posted a return of 5.7% in the first half of the year, citing strong returns on financial stocks.

The $2 trillion fund is divesting from 11 Israeli companies while holding onto relationships with prominent American executives who have stood firmly behind Israel since Oct. 7 ... Nicolai Tangen, chief executive officer of Norges Bank Investment Management, during the presentation of the sovereign ...

The $2 trillion fund is divesting from 11 Israeli companies while holding onto relationships with prominent American executives who have stood firmly behind Israel since Oct. 7 ... Nicolai Tangen, chief executive officer of Norges Bank Investment Management, during the presentation of the sovereign wealth fund's half-year earnings at the Arendalsuka conference in Arendal, Norway, on Tuesday, Aug.Norway’s sovereign wealth fund said on Monday that it was divesting from 11 Israeli companies and had terminated its contracts with external fund managers in Israel over concerns regarding the humanitarian crisis in Gaza and the West Bank.

Norfund – the Norwegian Investment Fund for Developing Countries – invests in the establishment and development of profitable and sustainable enterprises in developing countries. The aim is to contribute to economic growth and poverty reduction. Norfund always invests with partners, Norwegian ...

Norfund – the Norwegian Investment Fund for Developing Countries – invests in the establishment and development of profitable and sustainable enterprises in developing countries. The aim is to contribute to economic growth and poverty reduction. Norfund always invests with partners, Norwegian or foreign, focusing on renewable energy, agribusiness and financial institutions.Norfund also has a grant facility that is designed to strengthen the development effects of our investments.

Norway’s sovereign wealth fund, managed by Norges Bank Investment Management (NBIM), has increased its indirect holdings of Bitcoin to 7,161 BTC, valued at approximately $862.8 million as of June 30, according to new analysis from K33.

Norway’s sovereign wealth fund, managed by Norges Bank Investment Management (NBIM), has increased its indirect holdings of Bitcoin to..,Lunde pointed out that per capita, NBIM’s Bitcoin exposure now amounts to roughly 1,387 Norwegian kroner, or about $138, for each Norwegian citizen.The report also placed the fund’s Bitcoin exposure within the context of BTC’s recent market performance.

Norwegian Investment Fund for Developing Countries (NORFUND) is a Norway based organisation that provides capital and experience to private enterprises in most countries in Africa, Asia, Latin America and the Balkans. Any country with a GDP under USD 5295 per capita is eligible for investments.

They can provide equity and debt financing for new business ventures, expansions, management buy-ins and buy-outs. NORFUND can invest in most sectors of the economy as long as the investment offers opportunities for growth, profitability and local development.NORFUND has offices in Norway, South Africa, Kenya, Costa Rica and Thailand.

The Norwegian Investment Fund for Developing Countries (Norfund), is the Norwegian development finance institution. It was established by the Norwegian Parliament in 1997 and it is owned entirely by the Norwegian Ministry of Foreign Affairs.

The Norwegian Investment Fund for Developing Countries (Norfund), is the Norwegian development finance institution. It was established by the Norwegian Parliament in 1997 and it is owned entirely by the Norwegian Ministry of Foreign Affairs. Norfund joined the European Development Finance Institutions Association (EDFI) in 2001.Norfund ranked 11th in the Core Information component, with 11.25 out of 20. This represents an improvement from 2023, when it placed 16th. As well as improvement on the accessibility indicator, progress in this component included new disclosures on unique identifiers, funding source, client description and approval date.Finally, Norfund ranked joint last in the Financial Intermediary (FI) Sub-Investments component, scoring 0 out of 10. This is a drop from 2023, when it was one of five non-sovereign DFIs to score for disclosing private equity fund sub-investments, which were not disclosed this time when doing the assessment.Norfund should develop a policy for disclosing financial intermediary sub-investments in line with Publish What You Fund’s DFI Transparency Tool and resume disclosure of private equity sub-investments, as it has done in the past.

Norfund is the Norwegian Investment Fund for developing countries.

Norfund is owned and funded by the Norwegian Government and is the Government´s most important tool for strengthening the private sector in developing countries, and for reducing poverty.Norfund's mandate is defined by the Norfund Act of 1997.The Act states that Norfund´s role is to assist in building sustainable businesses and industries in developing countries by providing equity capital and other risk capital.Norfund helps to build sustainable businesses that would not otherwise be developed because of the high risks involved.

Fund management said last week that the sovereign wealth fund would exit Caterpillar and several Israeli banks over concerns about ties to the conflict in the Gaza Strip. Norway's finance minister, Jens Stoltenberg, said in a Thursday statement that the fund's withdrawal from Caterpillar was ...

Fund management said last week that the sovereign wealth fund would exit Caterpillar and several Israeli banks over concerns about ties to the conflict in the Gaza Strip. Norway's finance minister, Jens Stoltenberg, said in a Thursday statement that the fund's withdrawal from Caterpillar was "not political" and the government had no role in picking which individual stocks the fund allocates capital to.More broadly, decisions about the fund were divided between the country's Ministry of Finance, its central bank and the fund's own ethics council, he added. "The government is not involved in assessing individual companies," he said. "The decision to exclude companies is an independent decision made by the Executive Board of Norges Bank, in accordance with the established framework.Stoltenberg added that he had been part of a Norwegian delegation involved in talks with Trump's economic advisor, Kevin Hassett, on Tuesday. "We discussed trade and tariffs, economic sanctions against Russia and support for Ukraine," he said. "The pension fund was not a topic of discussion."Last week, Norges Bank Investment Management, or NBIM — which manages the fund on behalf of the Norwegian population — said it would exit its stake in Caterpillar and five Israeli banks, citing "unacceptable risk that the companies contribute to serious violations of the rights of individuals in situations of war and conflict."

The seller of the property is a joint venture between the California State Teachers’ Retirement System and Silverstein Properties, the fund added. Norway wealth fund buys 95% stake in New York office building

OSLO (Reuters) -Norway’s sovereign wealth fund said on Tuesday it has bought a 95% stake in an office property located along New York City’s Avenue of the Americas.A unit of Beacon Capital Partners will buy the remaining 5% and manage the building on behalf of the two investors, the Norwegian fund said.Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate.

Norfund is the Norwegian Investment Fund for developing countries with 24.9 bill. NOK in total commitments (2019).

Norfund has recieved a new mandate to invest in Ukraine

The State Fund in Tromsø, managed by Folketrygdfondet, will soon start investing. Its office in the city center was officially opened on Monday by Norway's Minister of Finance Jens Stoltenberg (Labor) together with the former MoF and now MP Trygve Slagsvold Vedum (Centre), and Tromsø Mayor ...

The State Fund in Tromsø, managed by Folketrygdfondet, will soon start investing. Its office in the city center was officially opened on Monday by Norway's Minister of Finance Jens Stoltenberg (Labor) together with the former MoF and now MP Trygve Slagsvold Vedum (Centre), and Tromsø Mayor Gunnar Wilhelmsen.Les på norsk. "Opening the State Fund in Tromsø is a historical event. This is good for the city, the region, and for Norway's state budget and the budget balance," says the Norwegian Minister of Finance Jens Stoltenberg.The Centre Party leader and MP, Trygve Slagsvold Vedum, was also present at the opening. He launched the new fund in 2024 while serving as Minister of Finance. "State asset management is becoming increasingly important, and we do not want all this management to take place in Oslo [Norway's capital, ed.Tromsø (High North News): On Monday, the Norwegian Minister of Finance Jens Stoltenberg opened the State Fund in Tromsø, which will invest in Nordic small-cap listed companies. This establishment will strengthen Northern Norway's financial environment, says Stoltenberg.

Norway’s sovereign wealth fund, which reportedly invests about $2 trillion, divested in recent days from 11 Israeli companies it says do not meet its “equity benchmark.” More than that, it plans to move the other 50 companies in which it invests in-house, Norges Bank Investment Management ...

Norway’s sovereign wealth fund, which reportedly invests about $2 trillion, divested in recent days from 11 Israeli companies it says do not meet its “equity benchmark.” More than that, it plans to move the other 50 companies in which it invests in-house, Norges Bank Investment Management announced on Monday.Fund managers have divested from Israeli companies before, citing what they say were “particularly serious violations of fundamental ethical norms” and “serious violations of individuals’ rights in situations of war or conflict,” among other issues.The 11 Israeli companies that the fund cut off are guilty of “serious norm violations associated with business operations in the West Bank,” it said.“These measures were taken in response to extraordinary circumstances,” stated Nicolai Tangen, CEO of Norges Bank Investment Management. “We are invested in companies that operate in a country at war, and conditions in the West Bank and Gaza have recently worsened. In response, we will further strengthen our due diligence.” · At the end of the 2024 fiscal year, the fund’s investment in the State of Israel totaled about $216 billion in 65 companies, representing 0.1% of its investments.

Norfund is the Norwegian Investment Fund for developing countries.

Learn more about Norwegian Investment Fund for Developing Countries's jobs, projects, latest news, contact information and geographical presence. Norfund is the Norwegian Investment Fund for developing countries. Their mission is to create jobs aNorfund is fully funded by the Norwegian International Development Assistance budget.Norwegian Investment Fund for Developing CountriesNorfund’s mandate is defined by the Norfund Act of 1997.

Norfund is a development finance institution established by the Norwegian Storting (parliament) in 1997 and owned by the Norwegian Ministry of Foreign Affairs. The fund receives its investment capital from the state budget, and surpluses in the portfolio are reinvested.

In addition, Norfund invests in the transition to net zero emissions in emerging markets. The fund assists in building sustainable businesses and industries in developing countries by providing equity capital and other risk capital in businesses that would not otherwise be funded.The investments are done on commercial terms directly in companies or through local investment funds. Norfund invest in developing countries, and has chosen a strategic focus on Sub-Saharan Africa, and selected countries in Central America and South-East Asia.Renewable energy, financial inclusion, green infrastructure and scalable enterprises are the four main areas in which Norfund invests. Norfund is mainly an equity investor (normally no higher share than 35%), but the fund can also issue loans.In July 2021, the Norwegian Government announced that it had decided to allocate NOK 10 billion over a period of five years for a new fund that will invest in renewable energy in developing countries with the aim of reducing greenhouse gas emissions. Norfund was given responsibility to manage the Climate Investment Fund on behalf of Norway's Ministry of Foreign Affairs.

The Norwegian Investment Fund for Developing Countries (Norfund), is the Norwegian development finance institution. It was established by the Norwegian Parliament in 1997 and it is owned entirely by the Norwegian Ministry of Foreign Affairs.

The Norwegian Investment Fund for Developing Countries (Norfund), is the Norwegian development finance institution. It was established by the Norwegian Parliament in 1997 and it is owned entirely by the Norwegian Ministry of Foreign Affairs. Norfund joined the European Development Finance Institutions Association (EDFI) in 2001.Norfund ranked 11th in the Core Information component, with 11.25 out of 20. This represents an improvement from 2023, when it placed 16th. As well as improvement on the accessibility indicator, progress in this component included new disclosures on unique identifiers, funding source, client description and approval date.Finally, Norfund ranked joint last in the Financial Intermediary (FI) Sub-Investments component, scoring 0 out of 10. This is a drop from 2023, when it was one of five non-sovereign DFIs to score for disclosing private equity fund sub-investments, which were not disclosed this time when doing the assessment.Norfund should develop a policy for disclosing financial intermediary sub-investments in line with Publish What You Fund’s DFI Transparency Tool and resume disclosure of private equity sub-investments, as it has done in the past.

Norfund - The Norwegian Investment Fund for Developing Countries, is owned by the Norwegian Government and serves as an instrument in Norwegian development policy. Norfund contributes to poverty reduction and economic development in the poorest countries through investments in profitable businesses ...

Norfund - The Norwegian Investment Fund for Developing Countries, is owned by the Norwegian Government and serves as an instrument in Norwegian development policy. Norfund contributes to poverty reduction and economic development in the poorest countries through investments in profitable businesses and transfer of knowledge and technology.The main sector for investment is clean energy. Norfund is Norway's biggest investor in microfinance through the Norwegian Microfinance Initiative (NMI), and is also a prominent investor in small and medium sized businesses through regional funds and direct investments.Norfund's geographical focus is on Sub-Sahara Africa, where the fund has three regional offices (Nairobi, Cape Town and Accra). In addition, Norfund invests in selected countries in Asia and Latin America, with regional offices in Costa Rica and Bangkok.At the same time, global foreign direct investments in developing countries dropped 9%. 🌍 Over half of the investments in 2023 went to Africa. 34% went to Asia and 16% to Latin America. 🌱 With investments now 2.5 times the amount transferred from the Norwegian government, Norfund shows the effectiveness of investing with profit and using the same funds several times.

Norway is one of the richest countries in the world. It has a generous welfare state, sits on billions of barrels of oil and gas, and has one of the world’s largest sovereign wealth funds, worth around 20 trillion kroner ($2 trillion).

Gross domestic product per person is the sixth-highest in the world, one place above the U.S., according to the International Monetary Fund. Progress Party (Frp) leader Sylvi Listhaug casts her vote at Norway’s Parliamentary elections in Oslo, Norway, Monday, Sept.A close outcome is expected between a center-left bloc led by the Labor Party of Prime Minister Jonas Gahr Støre and a right-wing bloc.The future of a wealth tax has been a central issue.OSLO, Norway (AP) — Norwegians headed to the polls Monday in the main day of voting for a new parliament, after a campaign in which the future of a wealth tax that dates to the late 19th century has been a central issue.